What's New or Changing for 2026?

MEDICAL

Medical coverage will remain with United Healthcare (UHC), but Pharmacy Medications will be administered by TrueScripts.

- This change includes improved support for questions/issues including a robust member portal with drug price lookup, live and text chat, claims history, etc.

- Deductible and Out of Pocket maximum credit will be allowed if members find lower costs through discount programs like GoodRx

- All enrolled associates will receive new medical/Rx ID cards closer to January 1. You will need to make sure you show your new ID card to the pharmacy when you pick up scripts in January.

- A webinar recording specifically about TrueScripts’ services and pertinent details will be available as we move closer to the new year, along with other information.

DENTAL

Dental coverage will be administered by Guardian.

The Guardian network has over 100 dental providers that BGDC members have utilized that will now be in-network.

Guardian has a maximum rollover provision that allows you to build up to a higher annual maximum.

Enrolled associates will not receive printed ID cards. Providers just need your basic information and employer name to confirm coverage. You can also download the Guardian Anytime mobile app and have your ID card information on the app.

VISION

Vision coverage will be administered by Guardian, using the Davis provider network.

- Reduced materials copay $30 with MetLife to $20 with Guardian

- Elective contact allowance increasing to $120 with Guardian + 15% off balance

- Higher out of network allowances with Guardian for those who go out of network

- Enrolled associates will not receive printed ID cards. Providers just need your basic information and employer name to confirm coverage. You can also download the Guardian Anytime mobile app and have your ID card information on the app.

TELEMEDICINE

Telemedicine visits for the High Deductible Health Plan will now mirror PPO copays and you do not have to meet the deductible.

HSA & FSA

- HSA annual maximum increasing (more tax savings opportunities!)

- Healthcare FSA maximum and rollover amount increasing (more tax savings opportunities!)

- Dependent Daycare FSA annual maximum increasing (more tax savings opportunities!)

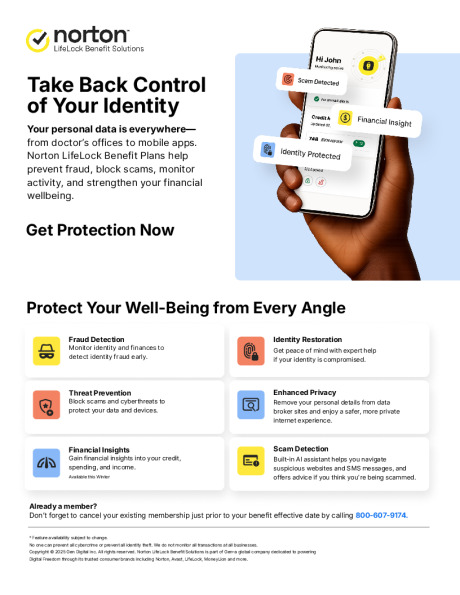

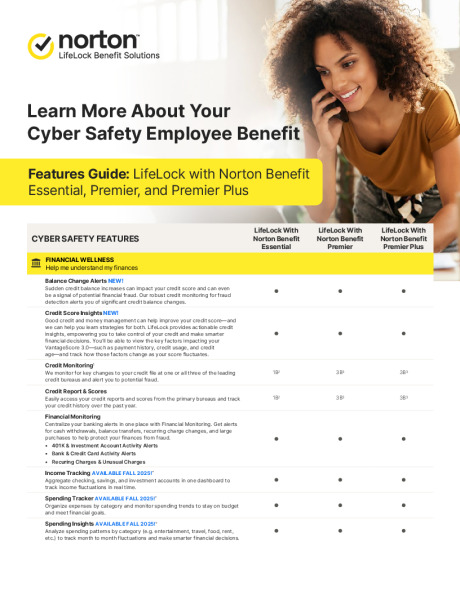

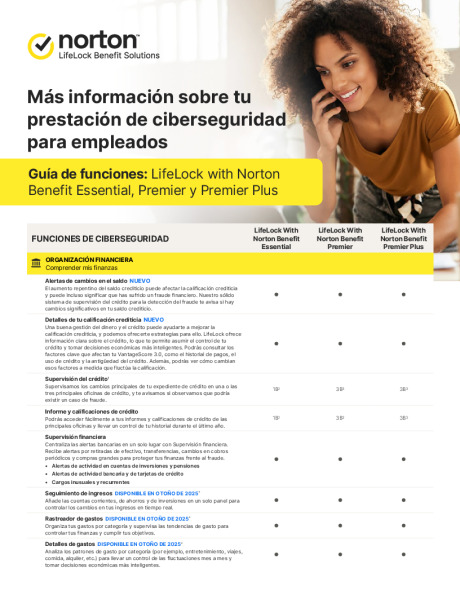

ID THEFT

ID Theft is moving to Norton Lifelock and there will be 3 options to select from.

- Improved coverage for ID theft of up to $3 million (currently $1 million).

- More electronic devices covered.

- All 3 plan options have Child Identity Protection on family plans. Unlimited devices covered on family plans for Premier / Premier Plus plan options.

- New Premier Plus option has up to $50,000 Cyber Crime Insurance, and Norton AntiTrack protection.

- If you currently have voluntary ID Theft coverage with MetLife:

- If you have the Protection base plan you will be enrolled in the Norton Essential plan, which has very similar coverage and rates.

- If you currently have the Protection Plus plan you will be enrolled in the Norton Premier plan, which has very similar coverage and rates.

- If you want the new Premier Plus plan, you will have to call the Enrollment Call Center to elect this new option.

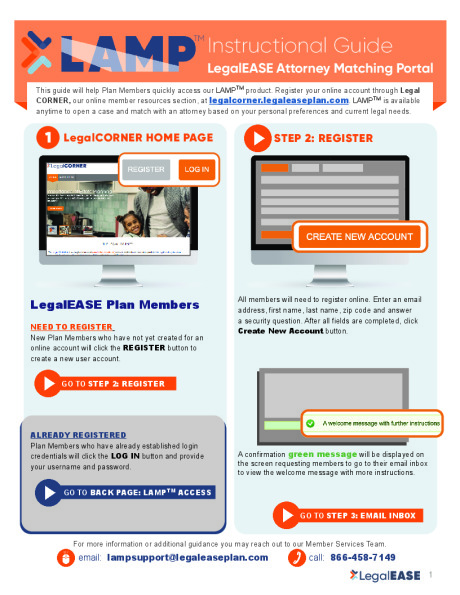

LEGAL PROTECTION

Legal Protection is moving to LegalEase.

- Improved coverage for contested and non-contested divorces, mediation, and several other service categories.

- Includes proprietary TurnSignl mobile app for traffic stop and accident situations with real time recording and real-time video chat capabilities with an attorney.

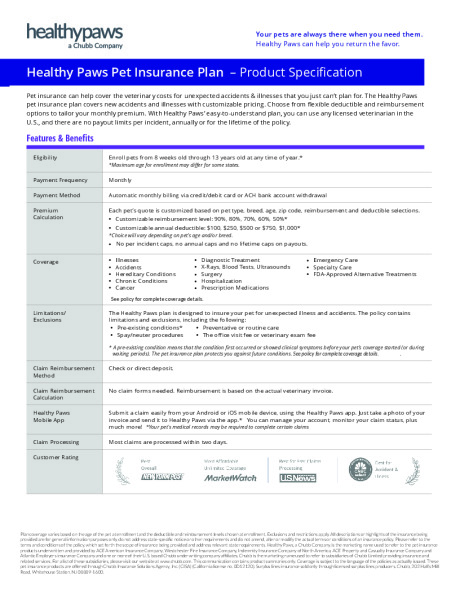

PET INSURANCE

Pet insurance is moving to Healthy Paws.

LIFE & DISABILITY

- Lifetime Benefit Term with Long Term Care coverage (Chubb)

- Remaining with Chubb, but they’re offering the $100,000 guarantee issue for all associates up to age 70 regardless of date of hire for 2026 open enrollment (typically only offered during the first year enrollment). If associates previously applied in a previous year and were officially declined, this will not allow them to reapply.

- No benefit changes.

- Life and disability coverages will be administered by Guardian:

- There will be a true open enrollment on the Voluntary Life/AD&D for 2026, allowing associates and spouses to enroll up to the Guarantee Issue without answering health questions for 2026. If you or your spouse have a chronic or acute health condition that may typically cause a life insurance denial, this is an important opportunity for you to elect up to the Guarantee Issue amounts.

- Future years will allow up to $50,000 increase for associates (not spouses) without answering health questions (up to Guarantee Issue amount).

- Improvement in Evidence of Insurability (EOI) process for associates. You will be able to complete a link on a website to submit, rather than completing a form that has to be printed/mailed/scanned/submitted.

- Spouses eligible for 100% of associate Voluntary Life amount (currently capped at 50%)

- No rate changes other than age-band changes.

Please review the BGDC Distribution 2026 Benefit Guide in its entirety and watch the 2026 Benefits Presentation video. Reach out to Human Resources or the Enrollment Call Center if you have any additional questions.