Medical Plans

BGDC offers the Enhanced PPO Plan and High Deductible Health (HDHP) Plan with HSA to Roanoke and Atlanta Union members. The coverage is administered by United Healthcare and includes prescription drug coverage through OptumRx. The network of providers is the United Healthcare Choice Plus national network.

The plans will give you the choice of going to see any physician or hospital you choose, but you receive the maximum level of benefits if you receive care from in-network providers. While this plan allows you to receive services in- and out-of-network, it remains your responsibility to make sure you are using in-network providers in order to receive the benefits of the plan’s in-network benefit schedule. If your out-of-network provider charges more than the “Maximum Allowable Amount”, as determined by United Healthcare, you may be subject to balance billing and higher deductibles and out of pocket maximums.

Please refer to the summary plan description for complete plan details. Find an in-network provider and review cost estimates at myuhc.

Medical Plan Comparison

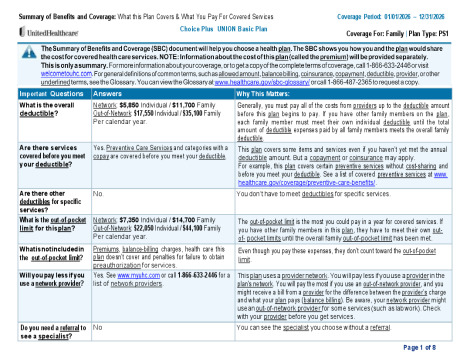

Enhanced PPO Plan

The Enhanced PPO Plan has the highest Associate premium contribution, but the lowest out-of-pocket costs compared to the Standard and Basic Plans. The Enhanced Plan has a copay for Primary Care Provider (PCP) office visits, and your preventive care services are covered at 100% when you use an in-network provider. The plan pays 80% in-network and 50% out-of-network after your deductible is met.

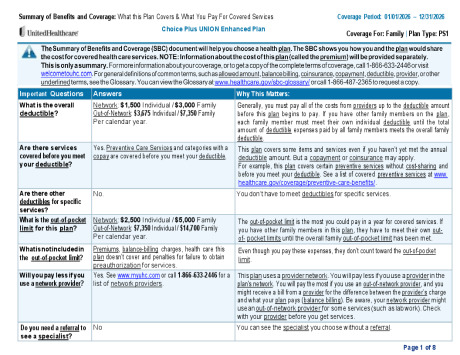

High Deductible Health (HDHP) Plan with HSA

The HDHP Plan has some of the highest deductible and out-of-pocket costs, but has the lowest Associate premium contribution of all the medical plan options. On the HDHP Plan your preventive care services are covered at 100% when you use an in-network provider but due to IRS guidelines for having a Health Savings Account (HSA), all other services including prescription drugs will not be paid by the plan until the deductible is met. The plan will pay 80% in-network and 60% out-of-network after your deductible is met.

Prescription Drug Coverage

You will receive prescription drug coverage administered by OptumRx. The plan covers both generic and brand-name medications. OptumRx offers a nationwide network of participating pharmacies and mail order services.

The prescription drug plan in the Enhanced have a separate prescription out-of-pocket (OOP) maximum. Once you hit the maximum your remaining prescription drug expenses will be paid at 100%. The Basic Plan does not have a separate prescription out-of-pocket maximum. Your prescription expenses will count towards the medical out-of-pocket maximum.

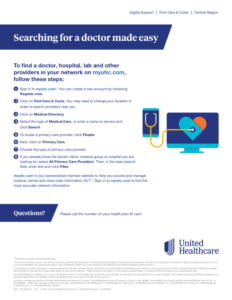

United Healthcare Online Resources

Once the plan year starts you can log on to your individual United Healthcare account at www.myuhc.com by clicking “Register Now” and following the step-by-step instructions. The UHC website offers many features and allows you to:

• Locate an in-network UHC provider

• Request a new ID card

• View and manage your benefits and health

• Review and print an Explanation of Benefits (EOB)

Medical Plan Overview

| UHC Enhanced Plan | ||||

|---|---|---|---|---|

| UHC PPO Enhanced Plan | ||||

| In-Network | Out-of-Network | |||

| Annual Deductible | ||||

| Individual | $1,500 | $3,675 | ||

| Family | $3,000 | $7,350 | ||

| Maximum Out-of-Pocket* (includes deductibles and copays) | ||||

| Individual | $2,500 | $7,350 | ||

| Family | $5,000 | $14,700 | ||

| Coinsurance | ||||

| Coinsurance (Plan pays after deductible is met) | 80% | 50% | ||

| Preventive Care | ||||

| Well Adult and Well Child Visits | Covered in Full | 50% after ded. | ||

| Physician Office Visits | ||||

| Primary Care | $30 copay | 50% after ded. | ||

| Specialty Care | $40 copay | 50% after ded. | ||

| Diagnostic Services | ||||

| X-ray and Lab Tests | 20% after ded. | 50% after ded. | ||

| Urgent Care | $50 copay | 50% after ded. | ||

| Emergency Room | 20% after ded. | 50% after ded. | ||

| Inpatient Facility | 20% after ded. | 50% after ded. | ||

| Outpatient Facility / Surgical | 20% after ded. | 50% after ded. | ||

| Mental Health | ||||

| Inpatient | 20% after ded. | 50% after ded. | ||

| Outpatient | Office: $30/visit Other: 20% after ded | 50% after ded. | ||

| Retail Pharmacy (30 Day Supply) | ||||

| Annual Pharmacy Out of Pocket Maximum (Single / Family) | Individual: $2,500 Family: $5,000 | |||

| Generic (Tier 1) | $10 copay | Not covered | ||

| Preferred (Tier 2) | 30%, $150 max | Not covered | ||

| Non-Preferred (Tier 3) | 40%, $200 max | Not covered | ||

| Preferred Specialty (Tier 4) | 30% | Not covered | ||

| Mail Order Pharmacy (90 Day Supply) (90 Day at Retail is available as well) | ||||

| Generic (Tier 1) | $25 copay | Not covered | ||

| Preferred (Tier 2) | 30%, $275 max | Not covered | ||

| Non-Preferred (Tier 3) | 40%, $500 max | Not covered | ||

| Preferred Specialty (Tier 4) | 30% | Not covered | ||

| UHC High Deductible Health Plan |

||||

|---|---|---|---|---|

| UHC High Deductible Health Plan |

||||

| In-Network | Out-of-Network | |||

| Annual Deductible | ||||

| Individual | $5,000 | $10,000 | ||

| Family | $10,000 | $20,000 | ||

| Maximum Out-of-Pocket* (includes deductibles) | ||||

| Individual | $7,500 | $15,000 | ||

| Family | $15,000 | $30,000 | ||

| Coinsurance | ||||

| Coinsurance (Plan pays after deductible is met) | 80% | 60% | ||

| Preventive Care | ||||

| Well Adult and Well Child Visits | Covered in Full | 40% after ded. | ||

| All Other Medical Services | ||||

| Primary Care / Specialty Care | 20% after ded. | 40% after ded. | ||

| Urgent Care / Emergency Room | 20% after ded. | 40% after ded. | ||

| X-ray and Lab Tests | 20% after ded. | 40% after ded. | ||

| Inpatient Facility | 20% after ded. | 40% after ded. | ||

| Outpatient Facility / Surgical | 20% after ded. | 40% after ded. | ||

| Retail Pharmacy (30 Day Supply) | Pharmacy Accumulates to Your Deductible & Medical Out-of-Pocket Maximum |

|||

| All Tiers of Prescriptions | 20% after ded. | 40% after ded. | ||

| Mail Order Pharmacy (90 Day Supply) (90 Day at Retail is available as well) |

||||

| All Tiers of Prescriptions | 20% after ded. | 40% after ded. | ||

Get To Know Your Care Options

How much you pay for care can depend on where you get it. For serious or life-threatening conditions, call 911 or go to an emergency room. For everything else, it may be best to contact your PCP first. If seeing your PCP isn’t possible, it’s important to know your other care options, especially before heading to the emergency room.