Health Savings Account (HSA)

Health Savings Account Overview

A Health Savings Account (HSA) is a tax-sheltered bank account that you own to pay for eligible health care expenses for you and/or your eligible dependents for current or future healthcare expenses with pre-tax dollars. The Health Savings Account (HSA) and any funds in it are yours to keep, even if you change jobs or medical plans. There is no “use it or lose it” rule; while there is an annual maximum contribution limit as noted below, there is no overall balance limit. If you don’t spend your dollars in a particular year your balance carries over year to year.

Plus, you get extra tax advantages with an HSA because:

- Money you deposit into an HSA is exempt from federal income taxes

- Interest in your account grows tax free

- You don’t pay income taxes on withdrawals used to pay for eligible health expenses. (If you withdraw funds for non-eligible expenses, taxes and penalties apply).

- You also have a choice of investment options which earn competitive interest rates, so your unused funds grow over time.

Are you eligible to open a Health Savings Account (HSA)?

Although everyone can enroll in the Qualified High Deductible Health Plan, not everyone is eligible to open and contribute to an HSA. If you do not meet these requirements, you cannot open an HSA.

- You must be enrolled in a Qualified High Deductible Health Plan (QHDHP)

- You must not be covered by another non-QHDHP health plan, such as a spouse’s PPO plan.

- You are not enrolled in Medicare.

- You are not in the TRICARE or TRICARE for Life military benefits program.

- You have not received Veterans Administration (VA) benefits within the past three months.

- You are not claimed as a dependent on another person’s tax return.

- You are not covered by a traditional health care flexible spending account (FSA). This includes your spouse’s FSA. (Enrollment in a limited purpose health care FSA is allowed).

2026 HSA Contributions

You can contribute to your Health Savings Account on a pre-tax basis through payroll deductions up to the IRS statutory maximums. The IRS has established the following maximum HSA contributions for the 2026 tax year:

- $4,400 Individual / $8,750 Family

- If you are age 55 and over, you may contribute an extra $1,000 catch up contribution

BGDC will make the below annual contributions for 2026 to your HSA:

- $1,000 for Employee Only

- $2,000 for Employee and Spouse

- $2,000 for Employee and Child(ren)

- $2,000 for Family

The combination of employee and employer contributions cannot exceed the annual IRS maximum amounts listed above.

Employer contributions will be deposited on the following timeline: 50% on January 1 and 50% as a dollar for dollar match per pay based on your contributions. BGDC’s dollar for dollar match of your own HSA contributions to the maximum amounts of $500/$1,000 (50% of the amounts stated above) will be deposited on a per pay basis. You may not be eligible for the entire amount depending on timing, HSA annual maximum contribution rules, and the amounts of your own contributions during the year.

If you’re joining the HSA mid-year, you can only contribute a pro-rated amount for the remainder of the year. If you are not joining the HSA on January 1st, you will not receive the January 1st BGDC employer contribution of $500/$1,000.

How do I get reimbursed for my eligible expenses?

The easiest way to use your HSA dollars is by using your HSA Debit Card at the time you incur an eligible expense (see link below). Or you can pay your physician or yourself back through the online portal or mobile app. There’s no need to turn in receipts (but keep them for your records). You must be able to prove that you were reimbursing yourself for an eligible expense if you are audited. If you use your HSA funds for non-eligible expenses, you will be charged a 20% penalty tax (if under age 65) as well as federal income taxes. For additional assistance, please go online or call Chard Snyder directly.

Keep Your Money

Unlike an FSA, the money in your HSA is always yours to keep and can be rolled over from year to year. You can take your unused balance with you when you retire or leave BGDC Distribution.

Invest In Your HSA Savings

Investing your HSA now allows you to be better prepared for future healthcare and retirement expenses. Your invested HSA funds grow tax free and remain tax free when you use them to pay for eligible healthcare expenses. You can also use your HSA as a long-term retirement investment option. After the age of 65, your HSA funds can be used for any non-healthcare expenses.

Your HSA Advantage account offers self-directed mutual fund investments to help you grow your healthcare savings for future needs. Easily manage your account from the Chard Snyder Mobile App or your online account.

Health Savings Brokerage Account

Along with your Chard Snyder HSA account, there is an opportunity for more targeted, strategic investment of your HSA dollars for retirement savings with Charles Schwab.

- Easy online enrollment into a Charles Schwab individual brokerage account through partnership with Healthcare Bank through Chard Snyder

- Investment choices from HSA-eligible mutual funds stocks, bonds, exchange-traded funds, fixed-income investments and money market funds

- Integrated online portal for 24/7 account management

- Ability to view balance and transaction details and personally manage HSA investments, including transfers, trading, and portfolio allocation monitoring

- Monthly account statements, trade confirmations, and regulatory materials sent via email or online paperless option

- Learn more about the investment options at the Chard Snyder Health Savings Account Brokerage page

Never pay taxes

Contributions are made on a before-tax basis, and your withdrawals will never be subject to federal income taxes when used for eligible expenses. Any interest or earnings on your HSA balance build tax-free, too.*

You can learn more at Chard Snyder’s HSA page.

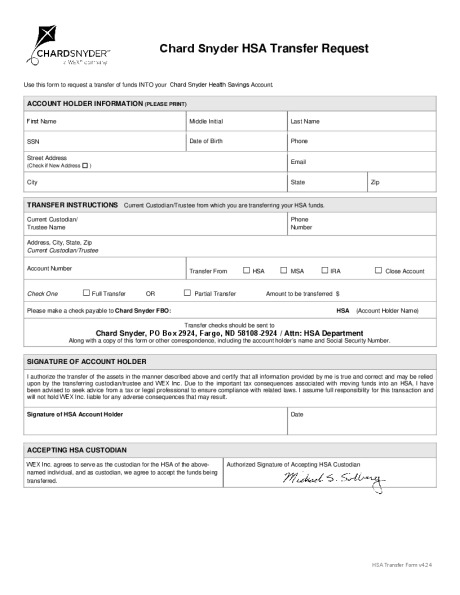

HSA Transfer of Current Funds

You can keep your current HSA balance with your current HSA bank if they allow individual accounts but your BGDC employer and associate contributions will need to go to a new account established with Chard Snyder (WEX).

- If your current HSA is through your previous employer, you will most likely need to transition it to an individual account through the HSA custodian (if they’ll allow it).

- Be aware there may be monthly administration fees on an individual account.

You can also transfer your balance to the BGDC HSA banking partner, Chard Snyder (WEX).

- You must complete the transfer according to IRS rules or you could face taxes and penalties.

- Request and complete the Chard Snyder HSA transfer form and send it to the bank that holds your prior HSA funds.

- Your funds are not available from either account for a period of days or weeks during the transfer. It may take up to 60 days to complete the process and you will not have access to funds during that time.

- You can wait until you have accumulated funds in your BGDC HSA to transfer from your previous account to still have access to HSA funds.